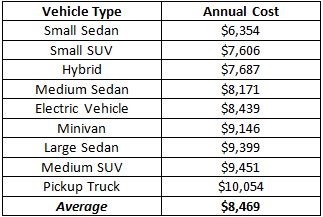

Average new car nearly $8,500 per year to own/operate; pickups cost over $10,000

BOISE – New vehicle owners need to factor more than a monthly payment into their purchase decisions. According to a new study by AAA, the average new vehicle costs nearly $8,500 annually to own and operate, while pickup truck owners pay more than $10,000 a year.

AAA’s Your Driving Costs study calculates the average costs for fuel, maintenance, repairs, insurance, license and registration (including taxes), depreciation, and loan interest for 45 vehicles from the 2017 model-year across nine categories. Calculations reflect new vehicle ownership over a five-year, 75,000-mile period. This year’s study adds four new categories – small SUVs, pickup trucks, hybrids and electric vehicles – based on consumer purchase preferences.

According to AAA’s study, pickup trucks are the most expensive new vehicles, even exceeding the costs of owning an electric or hybrid vehicle. While hybrids and electric vehicles depreciate faster, fuel savings and reduced maintenance costs make them more affordable than pickups in the long run.

“Many Idahoans rely on pickup trucks for work and recreational activities,” says AAA Idaho Public Affairs Director Matthew Conde. “AAA’s new study gives potential vehicle owners a better sense of the costs associated with vehicle ownership before they make a purchase decision.”

Here are some key considerations when making a new vehicle purchase:

- Fuel – Fuel costs vary by vehicle type. Electric vehicle owners pay about 3.68 cents per mile, while pickup owners pay about 13.88 cents per mile. On average, new vehicle owners can expect to pay about $1,500 annually just to fuel their vehicles.

- Depreciation – New vehicles decline in value, or depreciate, immediately. It’s the biggest and most often overlooked expense associated with purchasing a new vehicle. For the 2017 model-year, small sedans ($2,114) and small SUVs ($2,840) depreciate far less than the electric vehicles ($5,704) at the other end of the spectrum.

- “Depreciation is a major consideration,” Conde said. “It’s not just what you pay, but how much you could get for a vehicle if you sold it, or how much you would receive in replacement value if the vehicle was totaled.”

- Insurance premiums – “New vehicles feature the latest technology, which is more sophisticated and more expensive to repair and replace in the event of a collision,” Conde noted. “By its very nature, a new car frequently costs more to insure than a used one.”

- Financing – If you need to secure a loan for a new vehicle, interest rates and payment options will be impacted by the purchase price, as well as your credit score. You’ll also be required to carry comprehensive insurance coverage on the vehicle.

- Licensing, registration, and associated taxes – New vehicles generally carry a higher price tag, with corresponding fees.

Consumers can lower their driving costs in the following ways:

- Minimize depreciation costs by purchasing a used car, or a model that is known to hold its value over time.

- Select a vehicle that is less expensive to maintain. For customized budget advice, consumers can complete a worksheet at aaa.com/YourDrivingCosts.

- Shop around for the best rates on insurance and loans. AAA insurance professionals can provide a free no-obligation quote. For an insurance professional near you, go to https://www.oregon.aaa.com/get-insurance/

- Don’t overdo it. Many new vehicle owners change the oil too often, or use fuel grades their vehicles don’t need. Stick to the manufacturer’s specifications.

For more information on green vehicles, visit aaa.com/greencar.

“It’s important that drivers consider the total costs of vehicle ownership,” Conde said. “A recent AAA survey reports that one-third of U.S. drivers could not afford an unexpected repair bill without going into debt. We hope that drivers will budget according to their circumstances, and select a vehicle that is both functional and enjoyable.”