Press Release

Provided by the Idaho Center for Fiscal Policy.

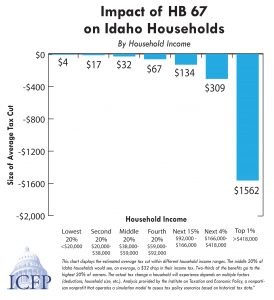

BOISE – The Idaho Center for Fiscal Policy released a report examining the impacts of proposed House Bill 67 and the current budget context. The proposal would cut top income tax and corporate tax rates and includes an elimination of the income tax on the first, small portion of a household’s income.

The legislation would reduce Idaho’s general fund revenue by around $51 million to $56 million. A majority of general fund spending (63% in fiscal year 2017) supports education.

The bill makes three main changes to Idaho’s tax system:

· A reduction to the individual income tax rate for the top bracket from 7.4% to 7.2%

· A reduction to the corporate income tax rate from 7.4% to 7.2%

· Elimination of the income tax on the first $750 of taxable household income (Note: the figure is $750 in statute and is adjusted each year for inflation, with a current value of $1,091)

Idaho Center for Fiscal Policy Director, Lauren Necochea, noted, “Lawmakers have expressed priorities that require additional funding, such as making good on the teacher career ladder commitment and bolstering rainy day funds to prepare for the next recession. The Legislature will have to weigh whether this tax cut is affordable in light of other stated priorities.”

The full report is available online at: http://idahocfp.org/new/wp-content/uploads/2017/01/HB67-Analysis-17jan30.pdf

The Idaho Center for Fiscal Policy is a nonpartisan, independent nonprofit program dedicated to providing data and research to improve public policymaking in Idaho. Learn more at idahocfp.org.